Due to COVID-19 pandemic and challenges faced by taxpayers, Government has extended dates for GST filings.

Normal Taxpayers filing Form GSTR-3B

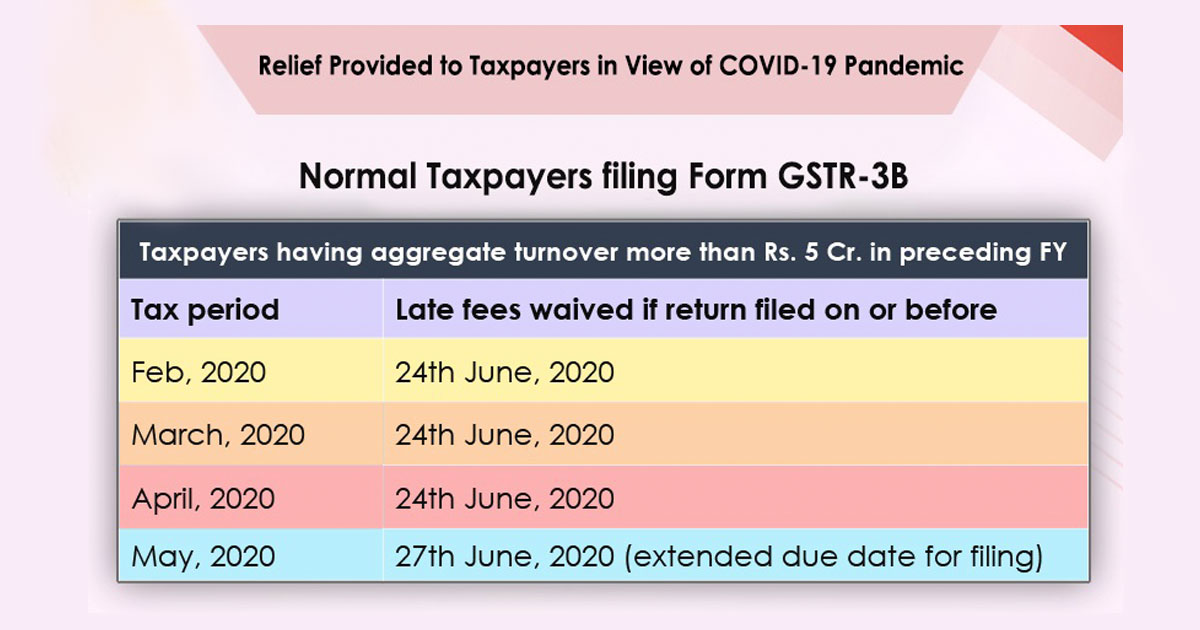

a.Taxpayers having aggregate turnover > Rs. 5 Cr. in preceding FY

| Tax period | Late fees waived if return filed on or before |

|---|---|

b.Taxpayers having aggregate turnover of > Rs. 1.5 crores and upto Rs. 5 crores in preceding FY

| Tax period | Late fees waived if return filed on or before |

|---|---|

c.Taxpayers having aggregate turnover of upto Rs. 1.5 crores in preceding FY

| Return/Tax period | Late fees waived if return filed on or before |

|---|---|

d.Taxpayers having aggregate turnover of upto Rs. 5 Cr. in preceding FY

| Tax period | Extended date and no late fees if return filed on or before | Principal place of business is in State/UT of |

|---|---|---|

Other Latest News

April 8, 2020 / GST News

All Pending Income Tax Refunds up to Rs 5 Lakhs

IT Department to release all pending income tax refunds up to Rs 5 lakhs immediately ; Around 14 lakh taxpayers to benefit.

Read More

March 24, 2020 / GST News

GST Return Due Dates 2020

The government has extended deadline for filing March, April and May 2020 GST returns to June 30, 2020.

Read More