One Person Company (OPC)

OPC is appropriate for sole entrepreneurs, seeking business privileges that are missed in a sole-proprietorship model. Essentially, it enables single owners to operate a corporate entity with limited liability protection.

Digital Filings can help you in…:

![]() Registering the Director with the Ministry of Corporate Affairs (MCA)

Registering the Director with the Ministry of Corporate Affairs (MCA)

![]() Finding a Unique Company Name and Getting it Registered

Finding a Unique Company Name and Getting it Registered

![]() Drafting the Company’s Constitution (MoA and AoA)

Drafting the Company’s Constitution (MoA and AoA)

![]() Obtaining INC-32 (SPICe) Approvals

Obtaining INC-32 (SPICe) Approvals

![]() Getting the Company’s TAN and PAN Issued by the NSDL

Getting the Company’s TAN and PAN Issued by the NSDL

Get Started!

Understanding the OPC Business Model

The OPC mode of business was recently brought in force, especially for Indian entrepreneurs through the Companies Act of 2013. The new model is considered to a promising substitute for the conventional sole-proprietorship form. The unique feature of OPC model is that it enables a solo-promoter to form a single person economic entity and let fully control all its functions, while limiting the liability to contributions to the business. The solo-person will be the only director and share-owner (there is, however, a nominee director with no power until the original director is incapable of entering into contract). There is, therefore, no scope of increasing equity funding or offering employee stock options.

Additionally, if an OPC touches an average three-year turnover of more than INR 2 crore or has a paid-up capital of over INR 50 lac, it’s bound to be transitioned into a private limited company or public limited company within six months of period. It is, therefore, critical for an entrepreneur to closely consider all the features of an OPC prior to incorporation.

Key-Advantages of an OPC

Continuous Existence

An OPC has a separate legal entity with perpetual / continuous existence as its ownership passes on to the nominee director. Moreover, the ownership can easily be transferred by altering the shareholding and nominee director details.

Borrowing Credibility

Since an OPC needs to have its books audited annually, it has a greater credibility among equity funding companies and lending institutions. An OPC, however, cannot issue any kind of equity security, as it is owned and controlled by a single person.

Property Ownership

Being an artificial person, an OPC can acquire, own, and alienate property (including machinery, building, land, factory, or others) in its name. Also, the nominee director cannot claim any ownership of the company unless and until he is holding that position.

Single Ownership

OPC is the only mode of corporate legal entity that can be formed and operated by a solo-promoter ensuring limited liability protection.

Required Documentation Chart

Indian Resident

- Self Attested and Scanned copy of PAN Card or Passport

- Self Attested and Scanned copy of Voter’s ID / Passport / Driver’s License

- Self Attested and Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)

- Scanned passport-sized photograph

- Specimen signature (blank document with signature)

For the Registered Office

- Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)

- Scanned copy of Notarized Rental Agreement in English

- Scanned copy of No-Objection Certificate from the property owner

- Scanned copy of Sale Deed/Property Deed in English (in case of owned property)

Note: Registered office can be a commercial space or even a residence.

Non-Resident Indian / Foreign Resident

- Notarized and Scanned copy of Passport*

- Notarized and Scanned copy of Passport / Driver’s License*

- Notarized and Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)*

- Scanned passport-sized photograph

- Specimen signature (blank document with signature)

*Documents to be apostilled if the director is from a Commonwealth country.

For the Registered Office

- Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)

- Scanned copy of Notarized Rental Agreement in English

- Scanned copy of No-Objection Certificate from the property owner

- Scanned copy of Sale Deed/Property Deed in English (in case of owned property)

Note: Registered office can be a commercial space or even a residence.

Connect to Our Experts Today!

Seasoned team of our vendor partners can effectively get your OPC registered and timely make it operational…

…so that you can manage and control your business, focusing on your mission critical tasks and proudly watching it Grow!

What People Frequently Ask…

What is a Digital Signature Certificate (DSC)?

DSC is required for all Directors of a proposed OPC as it establishes an electronic identity of the sender or signee while filing documents through the Internet. The MCA mandates that the Directors sign relevant the application documents using their Digital Signature.

What is Director Identification Number (DIN)?

DIN is a unique identification number that is mandatory for all existing and proposed Directors of an OPC. Any person can have only one DIN and it never expires.

How long the incorporation of an OPC is valid?

Once an OPC is incorporated, it will remain active as long as the annual compliances are regularly fulfilled. In case, however, the annual compliances are not complied, the OPC will become a Dormant Company and maybe struck-off from the register after a review period of up-to 20 years.

What is authorized capital and authorized capital fee?

Authorized capital of an OPC is the amount of shares a company can issue to its shareholders for which companies have to pay an authorized capital fee (a minimum of INR 1 Lac) to the government.

How many people are required to incorporate an OPC?

What are the requirements to be a Director or Nominee Director in an OPC?

What is the capital required to start an OPC?

Is an office required for starting an OPC?

A registered office address of India is required where the OPC will be situated, while the premise can be a commercial, industrial, or residential building where communication from the MCA will be received.

Pocket-Friendly Options

Basic

Package Include:

OPC registration with 2 DSC, 1 DIN, and 1 RUN Name Approval

OPC registration with 2 DSC, 1 DIN, and 1 RUN Name Approval INR 1 lac Authorized Capital

INR 1 lac Authorized Capital Incorporation Certificate, Incorporation Fee, and Stamp Duty

Incorporation Certificate, Incorporation Fee, and Stamp Duty Obtaining PAN and TAN

Obtaining PAN and TAN- (Above price includes all taxes and relevant government fees.)

Standard

Package Include:

OPC registration with 2 DSC, 1 DIN, and 1 RUN Name Approval

OPC registration with 2 DSC, 1 DIN, and 1 RUN Name Approval  INR 10 lac Authorized Capital

INR 10 lac Authorized Capital  Incorporation Certificate, Incorporation Fee, and Stamp Duty

Incorporation Certificate, Incorporation Fee, and Stamp Duty  Incorporation Kit and Share Certificates

Incorporation Kit and Share Certificates  Obtaining PAN, TAN, and GST Number (Above price includes all taxes and relevant government fees.)

Obtaining PAN, TAN, and GST Number (Above price includes all taxes and relevant government fees.)

Premium

Package Include:

OPC registration with 2 DSC, 1 DIN, and 1 RUN Name Approval

OPC registration with 2 DSC, 1 DIN, and 1 RUN Name Approval  INR 10 lac Authorized Capital

INR 10 lac Authorized Capital  Incorporation Certificate, Incorporation Fee, and Stamp Duty

Incorporation Certificate, Incorporation Fee, and Stamp Duty  Incorporation Kit and Share Certificates

Incorporation Kit and Share Certificates  Udyog Aadhaar and Trademark Registration

Udyog Aadhaar and Trademark Registration  Obtaining PAN, TAN, and GST Number (Above price includes all taxes and relevant government fees.)

Obtaining PAN, TAN, and GST Number (Above price includes all taxes and relevant government fees.)

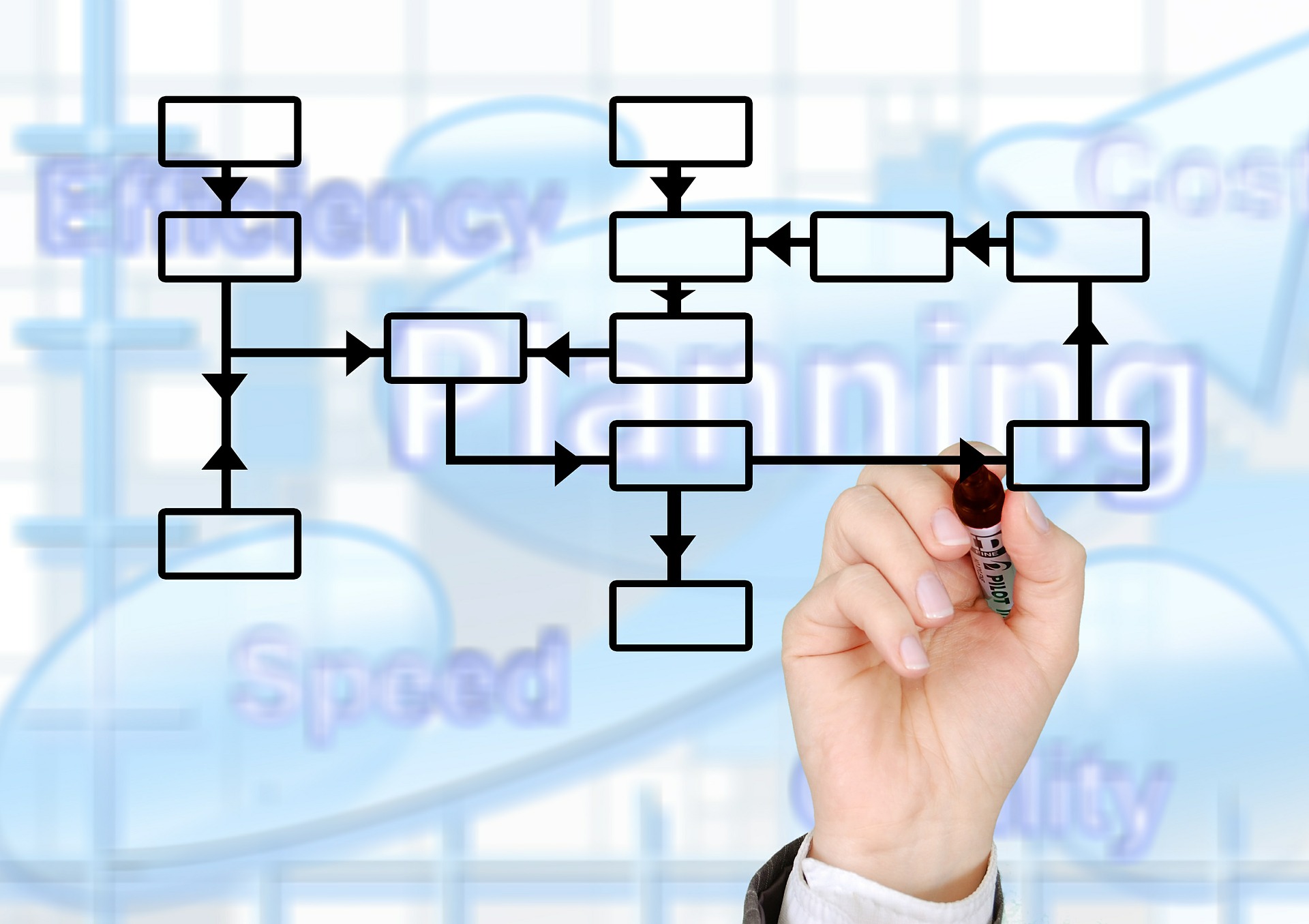

How we Do It…

Experienced partners at Digital Filings can assist you in registering and setting-up your OPC in a maximum of 10 to 15 business days, depending on the time coordination with the government authorities and clients.

Let’s Begin

Digital Filings will help you getting the Digital Signature Certificate (DSC) and Director Identification Number (DIN), which are necessary for the proposed director of the OPC as well as to submit the documents for company registration. We will assist you in obtaining these in 2 to 4 working days.

The Name Game

Post applying for the DSC and DIN, we will assist you selecting a name (there is an option of submitting at-least one and a maximum of six name choices to the authorities) for your OPC and will help you arrange the relevant documents. The details will be used to submit SPICe i.e. INC-32 as well as the MoA and AoA, post which the Certificate of Incorporation will be approved in 2 to 4 working days.

The Important Numbers

A registered PAN and TAN are obligatory for every company to operate. Digital Filings will help in submitting the online applications for your PAN and TAN, which will be couriered to your registered office address in 21 working days.

The Final Steps

Once the approval for company name is obtained we will help you submitting the incorporation documents along with registration request to the relevant authorities, which usually get processed in 5 to 7 business days.

Our Patrons’ Speak

Mission Statement

Every Partner at Digital Filings is Focused...

...to Provide a Comprehensive Legal Assistance Mechanism...

...Diligently Customized for Emerging Entrepreneurs!

We at a Glance...

Digital Filings is a leading business and legal services provider in India, assisting entrepreneurs in effectively and economically setting-up and managing their venture. Digital Filings consistently ensures that your venture is always compliant, so you can efficiently focus on making your business ascend.

Our strong network of proficient partners thoroughly understands the business specific regulatory/legal requirements and is focused to assist business owners at every stage of their venture.

Our panel of competent professionals, including Chartered Accountants, Company Secretaries, Lawyers, Cost Accountants, Chartered Engineers, Financial Gurus, and Business Experts are just a call away to gladly serve you.

Book your appointment Today!

Media Talks

Knowledge Arena

Be our guest to browse the Knowledge Arena by Digital Filings and widen your knowledge-base.

Digital Filings always strive to enhance the understanding of our patrons on the Nation's consistently modifying compliance environment. Our well-informed team of partners has diligently compiled numerous articles, guides, videos, and much more that you can browse anytime at your ease.

Why DigitalFilings

Easy Registration

Experts at Digital Filings can proficiently help in registering your sole proprietorship firm, either by getting you a GST / VAT Number, Service / Professional Tax Registration, a Shops & Establishments Act Registration, a Micro, Small & Medium Enterprises (MSME) Registration, or an Import-Export Code.

Supportive Team

The team of well-informed professionals at Digital Filings is just a phone call away to address every concern / query about the registration of your sole proprietorship venture. We will, however, put our best to make sure that all your questions are well-answered even before they strike in your mind.

Expert Support

Experts at Digital Filings precisely understand all of your requirements and strive to ensure that all the desired documents are in place so that you can effectively align yourself with every legal / administrative interaction. We will also provide you complete clarity on the process to set genuine expectations.

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”