Online Income Tax Return (ITR) Form-4

Individuals enrolled under the presumptive taxation scheme need to use Form ITR-4 to file their annual ITR.

Digital Filings can help you in…:

![]() Ascertaining the appropriate method to file ITR

Ascertaining the appropriate method to file ITR

![]() Understanding and compiling the relevant documents for filing ITR purposes

Understanding and compiling the relevant documents for filing ITR purposes

![]() Correctly computing the taxable amount

Correctly computing the taxable amount

![]() Seamlessly Filing ITR

Seamlessly Filing ITR

Get Started!

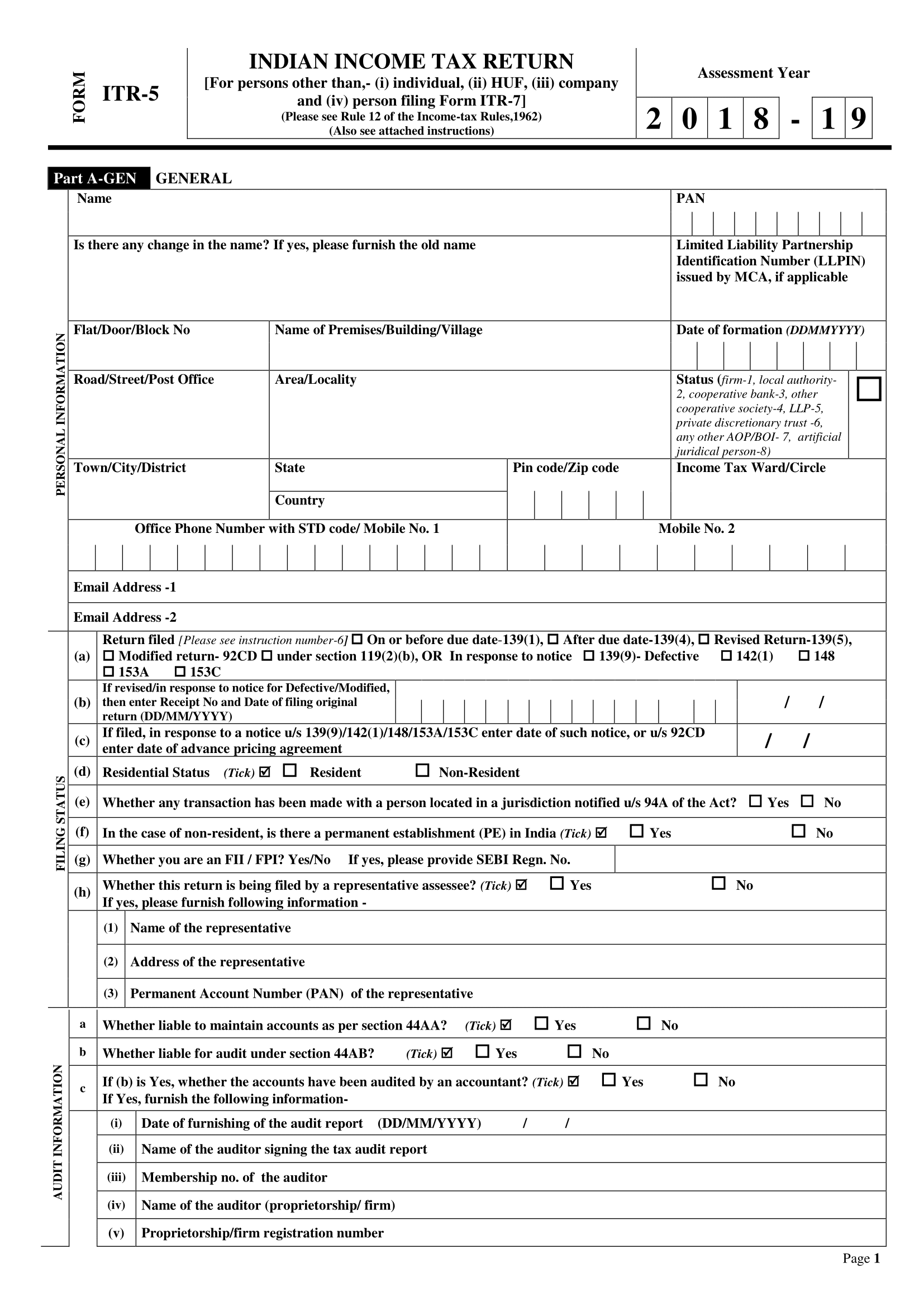

Understanding Form ITR- 4 SUGAM

As per the Section 44 AD, Section 44 ADA, and Section 44 AE of the Income Tax Act, a tax- payers are eligible to opt for presumptive income scheme as per their business requirement or the form of business. The scheme allows a tax payer to compute annual taxable amount on a presumed income basis instead of an actual earnings. Individuals, Professionals, and Hindu Undivided Families (HUF’s) who have opted for presumptive income scheme are obliged to use Form ITR- 4 SUGAM for filing their annual Income Tax Returns (ITR).

Any individual or HUF can opt for presumptive income scheme based on their respective annual income. In case of a business entity the annual income shall not exceed INR 2 Crores, while professionals can go for presumptive income scheme when their yearly receipts exceed INR 50 Lacs.

Following sources of income are taken into consideration while computing the annual taxable amount:

- Income from business (Under Section 44 AD or 44 AE)

- Income from a profession (Under Section 44 ADA)

- Salary or Pension

- Income from one house property (losses cannot be carried forward in this case)

- Other income sources (excluding lotteries and legal bets)

As per the Income Tax Department’s (ITD) guidelines, all individuals who need to file Form ITR- 4 SUGAM must complete the mandated statutory formalities of filing annual ITR by July 31st and in case of business September 30th is the due date for filing annual ITR.

Important Notes:

- Individuals and HUFs exceeding their respective annual turnover limits (as specified by the ITD) are not eligible to use Form ITR- 4 SUGAM

- Also, Companies are restrained to use the Form ITR- 4 SUGAM and are advised to file their annual ITRs using Form ITR- 6 or Form ITR- 7 (as per the applicability).

Understanding the Presumptive Taxation Scheme

Presumptive Income Scheme for Small and Medium Size Enterprises (SMEs)

The ITD has introduced the presumptive taxation scheme in financial year 2016- 2017. Business entities with an annual turnover of NOT exceeding over INR 2 Crores can get enrolled and claim benefits of the scheme.

The ITD has set an annual tax rate of 8% on the yearly turnover where the presumed income is considered for calculating the ITRs.

- For Instance, business entity with total annual turnover of INR 1 Crores need to file annual ITR equalling to INR 8 Lacs, which is computed as per the prescribed 8% tax rate. The rate is, however, applied on a presumed income that is based on the annual turnover.

Moreover, the presumptive taxation scheme has a determined minimum annual tax rate (i.e. 8%) chargeable on the presumed income, but there is no defined maximum tax rate. Any tax payer (professional or business) can willingly declare their respective profit margin, if its exceeding the taxable amount as per the minimum prescribed 8% tax rate.

Presumptive Taxation Scheme for Professionals

The ITD invites professionals (like engineers, doctors, chartered accountants) with gross receipts NOT exceeding INR 50 Lacs in a financial year to get enrolled under the Presumptive Taxation Scheme. ITD has set the tax rate at 50% on the annual gross receipts to compute the presumed income. Further, the taxable amount (i.e. 50% of total gross receipts) will be calculated under income tax head, “Profits and Gains of Business or Profession”.

- For Instance, a professional with INR 40 Lacs of annual gross receipts will be charged tax at 50% rate making it INR 20 Lacs, which will be the taxable income.

Likewise SMEs, a professional can also willingly declare more income, if exceeding 50% of the total annual receipts. A professional can claim for deductions under the presumptive taxation scheme such as salary paid to employees and interest paid to partners. As per the Sections 30 to 38, a professional is, however, not eligible to claim deductions for depreciation on assets.

Presumptive Taxation Scheme for Transporters

The ITD has extended presumptive taxation scheme for Transporters involved in activities, including plying, leasing, and / or hiring of goods carriages. A transporter can get enrolled under presumptive taxation scheme for owning NOT more than 10 goods carriages. Under this scheme, the presumed income is computed to be INR 7,500 each month that will be valid on all types of goods carriage vehicles, irrespective of heavy or light.

We are Glad to Help!

Indian Taxation Department has mandated every Indian Citizen, including businesses and individuals, to file their respective annual ITRs in the prescribed Forms.

Do Not Worry!

Taxation Specialists @ Digital Filings can effectively assist businesses and individuals in correctly identifying the appropriate ITR Forms, while also seamlessly help them in computing their annual taxable amounts and filing their annual ITRs.

Pocket-Friendly Options

Basic

Package Include:

ITR filing for a taxpayer with taxable income of less than INR 10 Lacs.

ITR filing for a taxpayer with taxable income of less than INR 10 Lacs.- (Above price includes all taxes and relevant government fees.)

Standard

Package Include:

ITR filing for a taxpayer with taxable income of less than INR 25 Lacs. (Above price includes all taxes and relevant government fees.)

ITR filing for a taxpayer with taxable income of less than INR 25 Lacs. (Above price includes all taxes and relevant government fees.)

Premium

Package Include:

ITR filing for a taxpayer with taxable income of more than INR 25 Lacs. (Above price includes all taxes and relevant government fees.)

ITR filing for a taxpayer with taxable income of more than INR 25 Lacs. (Above price includes all taxes and relevant government fees.)

How we Do It…

Individuals and HUFs enrolled under the presumptive income scheme are eligible to file the annual ITR by using form ITR- 4 SUGAM. Efficient Team @ Digital Filings will handle the entire procedure with ease.

Accumulating Data and Documents

An Expert @ Digital Filings will coordinate with individuals or businesses to identify and compile all the ITR related information and documents. Digital Filings expert will carefully extract important facts and figures to understand the financial performance and to compute the annual taxable amount for filing respective ITRs, accordingly.

Finding the Best Method

The ITD has provided numerous ways to file annual ITRs through Form ITR- 4 SUGAM. Expert @ Digital Filings will suggest you the most suitable method carefully considering your case.

- Paper Form – It is an offline method designed for senior citizens of the nation. Individuals above 80 years of age and not earning more than INR 5 Lacs can opt for this method.

- Digital Signature – It is an online method to file ITR where the Digital Signature of the tax- payer is used.

- Electronic Verification – It is again an online ITR filing method where data is transmitted electronically and the verification code is generated for successful submission of the Form ITR- 4 SUGAM.

- Filing ITR- V – It is an online process of filing ITR where data is transmitted electronically. Another form, ITR-V is filled and is sent to the ITD by post for verification purpose.

Finally its Done

After closely cross checking and putting the relevant information on Form ITR- 4 SUGAM and submitting the ITR application using the most suitable method, a Partner @ Digital Filings will intimate you through an e-mail or over phone regarding ITR filing status.

Our Patrons’ Speak

Mission Statement

Every Partner at Digital Filings is Focused...

...to Provide a Comprehensive Legal Assistance Mechanism...

...Diligently Customized for Emerging Entrepreneurs!

We at a Glance...

Digital Filings is a leading business and legal services provider in India, assisting entrepreneurs in effectively and economically setting-up and managing their venture. Digital Filings consistently ensures that your venture is always compliant, so you can efficiently focus on making your business ascend.

Our strong network of proficient partners thoroughly understands the business specific regulatory/legal requirements and is focused to assist business owners at every stage of their venture.

Our panel of competent professionals, including Chartered Accountants, Company Secretaries, Lawyers, Cost Accountants, Chartered Engineers, Financial Gurus, and Business Experts are just a call away to gladly serve you.

Book your appointment Today!

Media Talks

Knowledge Arena

Be our guest to browse the Knowledge Arena by Digital Filings and widen your knowledge-base.

Digital Filings always strive to enhance the understanding of our patrons on the Nation's consistently modifying compliance environment. Our well-informed team of partners has diligently compiled numerous articles, guides, videos, and much more that you can browse anytime at your ease.

Why DigitalFilings

Easy Registration

Experts at Digital Filings can proficiently help in registering your sole proprietorship firm, either by getting you a GST / VAT Number, Service / Professional Tax Registration, a Shops & Establishments Act Registration, a Micro, Small & Medium Enterprises (MSME) Registration, or an Import-Export Code.

Supportive Team

The team of well-informed professionals at Digital Filings is just a phone call away to address every concern / query about the registration of your sole proprietorship venture. We will, however, put our best to make sure that all your questions are well-answered even before they strike in your mind.

Expert Support

Experts at Digital Filings precisely understand all of your requirements and strive to ensure that all the desired documents are in place so that you can effectively align yourself with every legal / administrative interaction. We will also provide you complete clarity on the process to set genuine expectations.

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”