Personal Income Tax Filing

Individuals and NRIs are required to file income tax return, if their income exceeds Rs.2.5 lakhs per annum.

Digital Filings can help you in…:

![]() Understanding the Taxation requirements

Understanding the Taxation requirements

![]() Drafting required financial statements, including Income and Expenditure

Drafting required financial statements, including Income and Expenditure

![]() Computing Taxable amount

Computing Taxable amount

![]() Filing the annual return

Filing the annual return

Get Started!

Understanding Personal Tax Filings

Its is mandatory for individuals, NRIs, partnership firms, LLPs, companies and Trust to file income tax returns each year. Individuals and NRIs are required to file income tax return, if their income exceeds Rs.2.5 lakhs per annum. Proprietorship firms and partnership firms are required income tax return – irrespective of amount of income or loss.

All companies and LLPs are mandatorily required to file income tax return, irrespective of turnover or profit. DigitalFilings provides income tax efiling services with dedicated Tax Expert support. Upload your Form-16, sit back and relax. Our experts will file your income tax return and provide you the acknowledgement within 1 – 2 business days.

Penalty for Late Filing Income Tax Return

Taxpayers who do not file their income tax return on time are subject to penalty and charged an interest on the late payment of income tax. Also, the penalty for late filing income tax return on time has been increased recently. The penalty for late filing income tax return is now as follows:

- Late Filing between 1st August and 31st December – Rs.5000

- Late Filing After 31st December – Rs.10,000

- Penalty if taxable income is less than Rs.5 lakhs – Rs.1000

Income Tax Return Due Date

The due date for income tax return filing is 31st July of every year for individual taxpayers. The due date for income tax return filing for companies and taxpayer requiring tax audit is 30th September. Section 44AD of the Income Tax Act deals with tax audit under Income Tax Act.

Documents required for tax filing

We are Glad to Help!

Indian Businesses are liable to comply with all the applicable taxation regulations, including filing annual tax returns on their respective business incomes.

Taxation Experts @ Digital Filings can seamlessly assist businesses filing their obligatory annual business tax returns, enabling business owners to focus on their business critical matters.

Pocket-Friendly Options

Basic Package

1 Month GST FilingPackage Include:

GSTR-3B Return Filing

GSTR-3B Return Filing- (Above price includes all taxes and relevant government fees.)

Standard Package

6 Months' GST FilingPackage Include:

GSTR-3B Return Filing for 6 Months

GSTR-3B Return Filing for 6 Months Quarterly GSTR-1 Return Filing (Above price includes all taxes and relevant government fees.)

Quarterly GSTR-1 Return Filing (Above price includes all taxes and relevant government fees.)

Best Selling Package

12 Months' GST Filing- Package Include:

GSTR-3B Return Filing for 12 Months

GSTR-3B Return Filing for 12 Months Quarterly GSTR-1 Return Filing (+ all taxes and relevant government fees.)

Quarterly GSTR-1 Return Filing (+ all taxes and relevant government fees.)

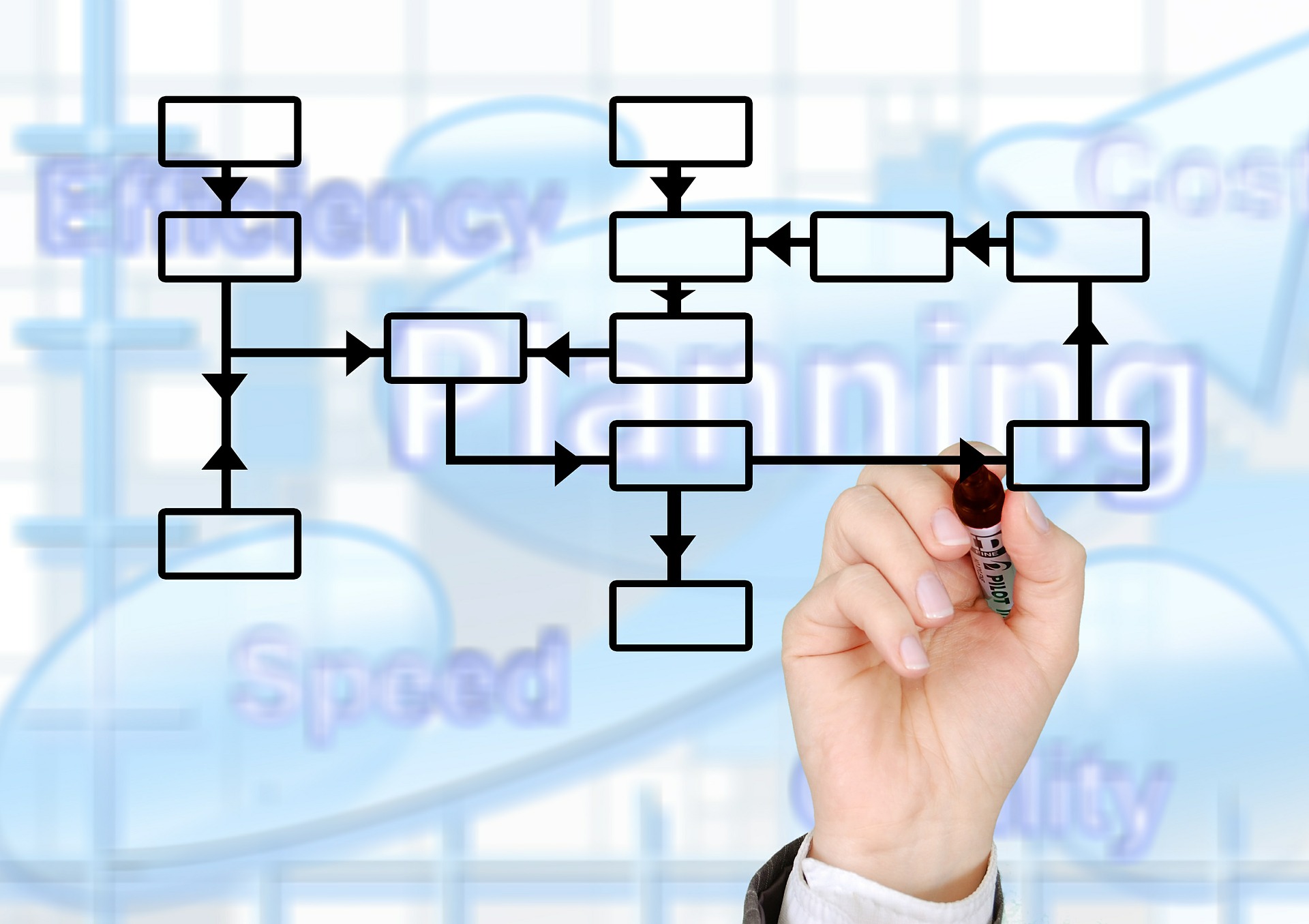

How we Do It…

According to the pertinent Income Tax Act for Annual Business Return Tax Filing, an entity is bound to pay taxes on its annual Income following the prescribed procedure and keeping in mind the tax filing due dates. Partners @ Digital Filings can efficiently assist businesses in completing all taxation formalities within 5 to 7 business days.

These Facts and Figures are Important

Before filing the annual tax returns, an expert @ Digital Filings will coordinate with the business owners to assess and understand the required information regarding the entity’s financial performance in order to compute the precise taxable amount. On basis of the collected information, the Balance Sheet and Profit and Loss account of the business entity will be prepared and further shared with its finance department for verification purposes.

Penning on an Appropriate Forms

The relevant Income Tax Return (ITR) Forms to be filled depend on the very structure of the business. For instance, Domestic Company set-ups like, Private Limited, Public Limited, and One Person Companies are instructed to fill Form ITR-6, whereas Partnership and LLP firms are advised to submit Form ITR-5 to file their annual ITRs. Team @ Digital Filings will flawlessly comprehend your business structure and take the process further, accordingly.

Submitting Successfully

After gathering all the relevant information and documents as well as furnishing the financial statements and correctly computing the taxable amount, Partners @ Digital Filings will duly file the tax returns with the concerned taxation authority. Business will be notified on successful submission of the taxable returns.

Our Patrons’ Speak

Mission Statement

Every Partner at Digital Filings is Focused...

...to Provide a Comprehensive Legal Assistance Mechanism...

...Diligently Customized for Emerging Entrepreneurs!

We at a Glance...

Digital Filings is a leading business and legal services provider in India, assisting entrepreneurs in effectively and economically setting-up and managing their venture. Digital Filings consistently ensures that your venture is always compliant, so you can efficiently focus on making your business ascend.

Our strong network of proficient partners thoroughly understands the business specific regulatory/legal requirements and is focused to assist business owners at every stage of their venture.

Our panel of competent professionals, including Chartered Accountants, Company Secretaries, Lawyers, Cost Accountants, Chartered Engineers, Financial Gurus, and Business Experts are just a call away to gladly serve you.

Book your appointment Today!

Media Talks

Knowledge Arena

Be our guest to browse the Knowledge Arena by Digital Filings and widen your knowledge-base.

Digital Filings always strive to enhance the understanding of our patrons on the Nation's consistently modifying compliance environment. Our well-informed team of partners has diligently compiled numerous articles, guides, videos, and much more that you can browse anytime at your ease.

Why DigitalFilings

Easy Registration

Experts at Digital Filings can proficiently help in registering your sole proprietorship firm, either by getting you a GST / VAT Number, Service / Professional Tax Registration, a Shops & Establishments Act Registration, a Micro, Small & Medium Enterprises (MSME) Registration, or an Import-Export Code.

Supportive Team

The team of well-informed professionals at Digital Filings is just a phone call away to address every concern / query about the registration of your sole proprietorship venture. We will, however, put our best to make sure that all your questions are well-answered even before they strike in your mind.

Expert Support

Experts at Digital Filings precisely understand all of your requirements and strive to ensure that all the desired documents are in place so that you can effectively align yourself with every legal / administrative interaction. We will also provide you complete clarity on the process to set genuine expectations.

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”